Banking isn’t new to India. It has been a part of the country’s economic ecosystem for over 200 years. It is also one of the sectors that have evolved significantly over the years and have always walked hand-in-hand with time.

Banking now forms an integral part of our lifestyle and our financial habits. It is because we trust banks a lot. However, we have many people, yet unaware of banking basics, such as what banks are, the types of banks, the various nationalized, private banks, etc. Arth Shikshan, through this blog that talks about a few such essential aspects of banking in India. We hope, the blog adds to the banking knowledge of people.

What is a bank?

A bank is a financial institution authorized and licensed to receive deposits, store them, enable its customers to withdraw money whenever required, and loan money. Additionally, banks also provide other financial services such as wealth management, lockers, currency exchange, etc. In India, the country’s banking system is regulated by the Reserve Bank of India (RBI), which is India’s central and regulatory body.

What are the different types of banks in India?

In India, banks are classified as the following.

Commercial Banks

In India, commercial banks are regulated by the Banking Regulation Act, 1949. These banks aim to earn profits. Fundamentally, they accept deposits and give loans to corporates, the government, and the general public. Commercial banks include public sector banks, private sector banks, foreign banks, and regional rural banks.

Small Finance Banks

As the name suggests, small finance banks aim to provide finance to micro industries, marginal farmers, and a lot of small businesses, and the unorganized sector. These banks are licensed under Section 22 of the Banking Regulation Act, 1949, and are governed by the provision of the RBI Act, 1934, and FEMA. Small finance banks support small businesses, and hence, contribute significantly to the Indian economy.

Cooperative Banks

Banks registered under the Cooperatives Act, 1912 and run by an elected managing committee are called cooperative banks. These banks work on a no-profit no-loss basis, and their target segment mainly includes small businesses, entrepreneurs, industries, and self-employed people across cities. Cooperative banks also cater to the rural parts of India. Their customers across this segment include people involved in activities such as farming, hatcheries, etc.

Payments Banks

Payments bank is a relatively new segment across the banking cosmos of India and was conceptualized by the RBI. Currently, payments banks have a deposit limited to INR 1 lakh per customer. These banks offer various other services that include net banking, mobile banking, ATM cards, and debit cards.

Nationalized, Private Sector, Foreign Banks, and Small Finance Banks in India

urther to the classification of banks, let us now look at a few banks that fall under the categories we look earlier.

Nationalized Banks:

Bank of India, State Bank of India, Bank of Maharashtra, Indian Bank, Union Bank of India, Central Bank of India, Indian Overseas Bank, Bank of Baroda, Punjab National Bank, Canara Bank, and Punjab and Sindh Bank, and UCO Bank

Private Sector Banks:

HDFC Bank, ICICI Bank, IDFC Bank, IDBI Bank, Bandhan Bank, Axis Bank, Karur Vysya Bank, Karnataka Bank, Jammu, and Kashmir Bank, IndusInd Bank, Federal Bank, etc.

Foreign Banks:

BNP Paribas, HSBC Bank, Qatar National Bank (QPSC), Bank of America, JP Morgan Chase Bank NA, Credit Agricole Corporate & Investment Bank, Deutsche Bank, and many others.

Small Finance Banks:

Capital Small Finance Bank Ltd., Jana Small Finance Bank Ltd., Utkarsh Small Finance Bank Ltd., Equitas Small Finance Bank Ltd., Equitas Small Finance Bank Ltd., and others.

Facilities Provided by Banks in India

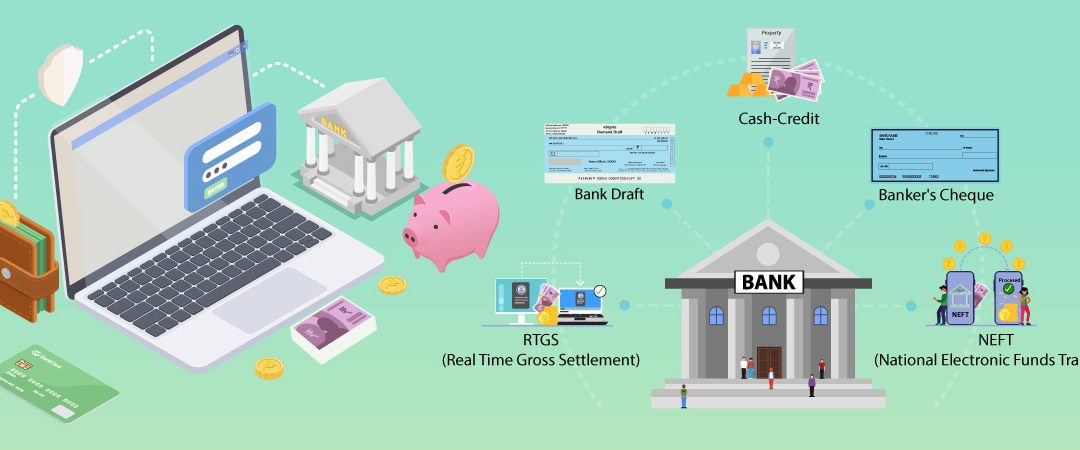

Banks provide an extensive range of facilities to their customers to simplify banking and enhance the banking experience. Let us quickly run through the five most significant ones.

1. Banker’s Cheque

A banker’s cheque is a pay order that a bank itself issues by withdrawing the required amount from the payer’s account. It also forms one of the methods of sending money by a bank. The banker issues a cheque in the name of the person or company to whom the customer wants to pay. Customers pay commission to the bank for this service. This facility is used to make local payments.

2. NEFT (National Electronic Funds Transfer)

NEFT is a modern-day electronic funds transfer system that involves online funds transfer from one bank to the other. NEFT does not have any minimum or maximum fund transfer limit. This facility is usually used by people who have bank accounts. However, it can be availed even by people who do not have an account. In the latter case, an individual can deposit cash at the NEFT-enabled branch and issue instructions to transfer funds through NEFT.

3. Bank Draft

Through the bank draft facility, customers, precisely account holders, can send money to other places. It requires account holders to fill a particular proforma with details as requested by the bank.

The bank issues a draft to the customer after it debits his account with the required amount. Further, the customer sends the draft to the person he is about to pay the money to. The draft recipient deposits the draft with his bank, and the bank credits the amount to his account. The bank intimates the branch, wherein the draft is payable. However, the bank draft is quite a time-consuming process and involves a considerable amount of fees.

4. Cash-Credit

Cash credit is another significant facility wherein a bank loans money based on a customer on his current assets, fixed assets, etc. While giving loans on assets, banks hypothecate them in the banker’s favor.

5. RTGS (Real Time Gross Settlement)

RTGS refers to funds transfer on a real-time and gross basis. In RTGS, there’s no waiting period for the transaction. The system settles the transaction as soon as it is processed. Further, gross settlement refers to settling the transaction on a one-to-one basis without netting or bunching it with any other transaction. But one must note that RTGS payments are final and irrevocable, and take place, and maintained, or controlled by the country’s central bank.

What is online baking?

Online banking is the newest form of banking. It involves customers conducting banking transactions through electronic mediums. It is a one-click banking facility that allows customers to transfer funds, pay bills, open bank accounts, check account statements, make service requests, seek information on various products, services, offers of the bank, apply for loans, etc. through a desktop, laptop, smartphone, tablet, etc.

Some of the services under online banking include electronic funds transfer (IMPS, RTGS, NEFT, etc.), ATMs, mobile banking, internet banking, and many others. It is a convenient form of banking as it allows 24/7 access to the bank account, makes digital payments anytime and anywhere, sends instant notifications and alerts about transactions, and helps customers avoid the hassles of handling a lot of cash and do cash transactions.

About Arth Shikshan

Arth Shikshan is a FinTech initiative that aims to enhance financial literacy by explaining several basic and advanced concepts relating to banking, finance, and financial technology in vernacular languages. It is hopeful about the difference that increasing financial literacy can make to a particular society.